8F, Tower One, Financial Center 88 Prosperity Street, Central Business District Singapore 048888

Always on Reliability

Trustchaininvestai provides a robust and dependable platform that operates seamlessly, ensuring that institutions can access their trading tools and resources whenever they need them. This reliability is crucial for making timely investment decisions.

-

99.95% uptime record

-

24/7 white glove VIP account services

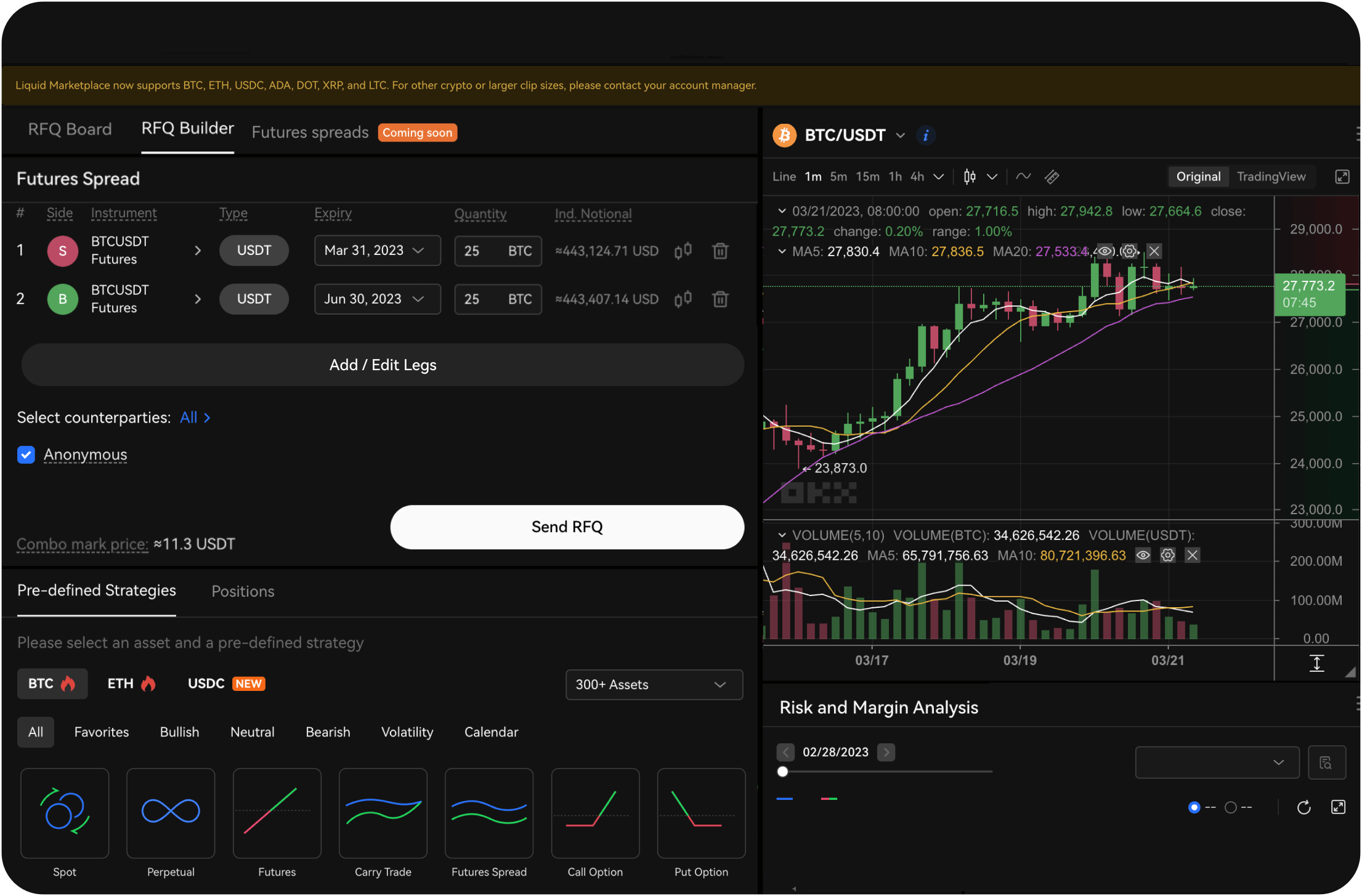

Deep Liquidity

The platform offers deep liquidity, meaning that there are ample opportunities for buying and selling assets without significant price fluctuations. This is particularly important for institutions that require the ability to execute large trades efficiently.

-

Second largest platform in global investment volume

-

26USD in peak daily trading volume

Capital Efficiency

Trustchaininvestai allows institutions to maximize their capital usage. With features like margin trading and optimized asset allocation, institutions can make the most of their investments while managing risk effectively.

-

Smart Portfolio margin tools

-

Risk offsetting tools

Unparalleled Performance

Unparalleled Performance: The platform is designed to deliver high performance, with fast execution times and advanced trading algorithms. This ensures that institutions can capitalize on market opportunities quickly and effectively.

-

5ms REST and Websocket API connectivity

-

400,000 request per second order matching

Competitive Fee

Trustchaininvestai offers competitive fee structures, which can significantly reduce the overall cost of trading for institutions. This cost efficiency allows them to allocate more resources toward their investment strategies.

-

Dynamic low fee tier structure

-

Upto 0% maker fee for VIPs